Summary

A proposal to add the Fasanara Clearpool USDC Yield Tranche as a new yield source for the USDC Best Yield strategies.

References

- Clearpool YTs as a new yield source for USDT BY - Fasanara post

- Clearpool YTs as a new yield source for USDC BY - Portofino post

- Fasanara Digital website

Proposal

After the successful integration of the Clearpool Fasanara USDT YTs, this new proposal aims to add one new Clearpool Yield Tranche to the Best Yield strategies based on USDC:

- Clearpool USDC (Fasanara) YTs, with specs available on GitHub here

Similar to previous Clearpool’s integration, Fasanara’s one would benefit doubly the Idle users

Yield Tranches are live since December 2021 holding a cumulative TVL of up to $50m.

Fasanara details

Fasanara Digital is a quantitative investment fund applying a scientific approach to investing in cryptoassets with the aim to achieve exceptional risk-adjusted returns for its investors.

Fasanara Digital was started in 2019 as part of Fasanara Capital, a 200 people London-based hedge fund founded in 2011 that specializes in alternative credit and fintech strategies. Overall, Fasanara Capital manages more than $4 billion across different funds.

With a team of 15 people fully dedicated to investments and development in digital assets, Fasanara Digital manages a delta-neutral high turnover fund specialized in market-making and arbitrage strategies. The fund trades approximately $10 billion per month in volume on both spot and derivatives on all major trading venues and has approximately $75 million in equity.

Clearpool (Fasanara) pool is live since the beginning of June. The Fasanara pool has a size of ~$550k and a maximum borrowing capacity of up to $40m. Credora rates the borrower with an AA.

| Protocol | Borrower | Capacity | Pool size | Credora’s rating |

|---|---|---|---|---|

| Clearpool | Portofino | $40,390,683 | $545,235 | AA |

At the time of writing, the Fasanara pool provides 21.73% APR with a 85% utilization rate (source).

Risk rating

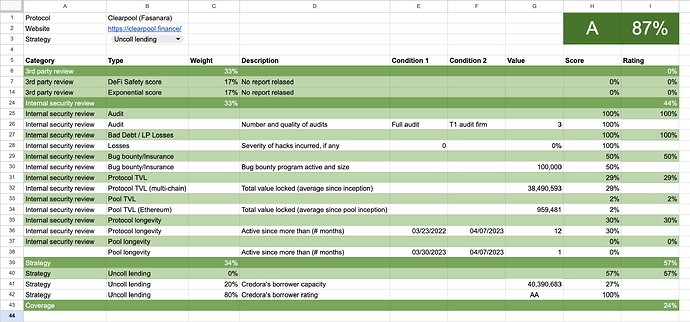

The borrower has been already analysed internally following the risk rating framework. The Clearpool (Fasanara) Yield Tranches can be considered as a valid market to become a new yield source of the Best Yield strategies.

In order to trigger any BY deployment, the Yield Tranches will need to have at least a 24% coverage on Senior funds coming from the Junior counterparty.

Next steps

We are going to leave this thread open for comments regarding this proposal, and soon, if there are no objections, we will open the temperature check.