TLDR

-

ICHI builds and incentivizes stablecoins for other projects, like $oneIDLE - always redeemable 1:1 to USDC, and backed by USDC + your project token ($IDLE).

-

Benefits for IDLE span from new yield opportunity for stablecoin deposits, a stable medium of exchange that can be used in IDLE protocol services and gives value back to $IDLE (requires $IDLE to mint new $oneIDLE), and more…

-

ICHI qualifies to meet IDLE’s Integrations Standard Requirements

-

Looking to get IDLE’s community feedback and ideas on $oneIDLE use-cases and potential collaborations.

Summary

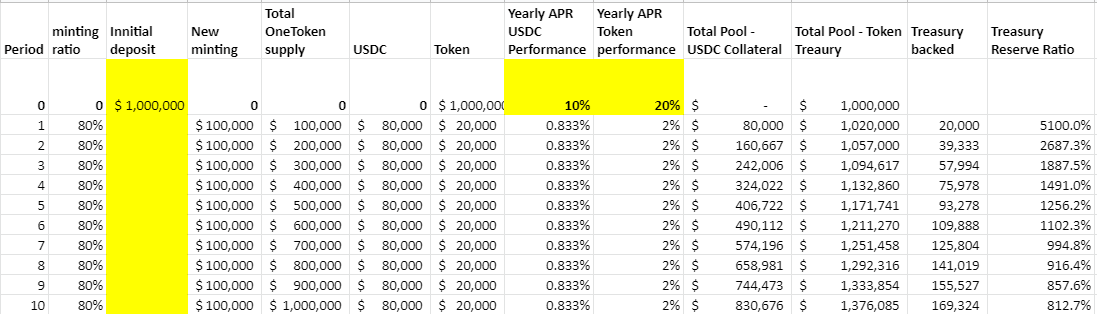

ICHI will launch $oneIDLE - a stablecoin redeemable 1:1 for USDC, and backed by USDC + $IDLE. $oneIDLE can be used across idle.finance as a stable medium of exchange governed by the stablecoin holders. Anyone can mint $oneIDLE by supplying USDC and $IDLE to the mint contract. This creates a reserve of USDC to ensure redemption at $1 and a community treasury of $IDLE

How will it work ?

IDLE provides strategies for stablecoin depositors to gain the best yields + earn $IDLE rewards. However, these depositors will usually want to simply farm $IDLE rewards with very little risk. They will then sell the $IDLE token for additional stablecoins.

Idle.Finance can turn this parasitic relationship between stablecoin suppliers and $IDLE holders into a beneficial one with the $oneIDLE stablecoin. When someone deposits $oneIDLE instead of another stablecoin into a strategy, users will benefit from the same or better rewards as other stablecoins, new rewards in the form of $ICHI and as oneIDLE holders they get a vote in the governance over the treasury backing it.

This creates a more powerful community by aligning the incentives between stablecoin suppliers and $IDLE holders. Essentially ICHI helps to offset protocol farming rewards effect (inflation) with organic demand for the native token

Today there are over $200M of stablecoins (DAI,USDC,USDT mainly) deposited in IDLE pools, providing their owners an average APY of 9.5% + almost $60K worth of $IDLE rewards are being distributed daily to these pools. What if IDLE could move some of this value to generate stable coin yield that is currently x5 (see oneTokens balancer pool) more, and generate demand to the $IDLE token at the same time ?

Collaboration ideas:

-

ICHI to build $oneIDLE stablecoin for the IDLE community. I would love to get this community feedback and ideas of what use cases could be implemented. From our experience talking to many project, there are multiple use cases for that:

-

Treasury diversification - IDLE can hold part of it’s treasury in a stable medium of exchange, while using $IDLE token.

-

Pay contributors in stablecoins - giving them a way to hedge token volatility + generate demand for $IDLE token (unlike using other stablecoins that require to give up on your token to acquire it)

-

Pay LP fees in a stable medium of exchange - the community can incentivize this by offering lower platform fees for those choosing to get rewards in oneIDLE vs. other coins

-

ICHI uses the collateral that backs it’s stablecoins and deploys it to work.

Example - oneBTC pool is a stablecoin backed by USDC and wBTC - with $1.5M one BTC minted - they hold $1.42M USDC and ~7 BTC. oneBTC holders, who govern this pool of token, can decide to take $0.5m of the USDC collateral and have it “work” using IDLE.FINANCE yield strategies.

- IDLE deploys USDC that users deposit to optimize the yield they get on their stablecoin. IDLE.FINANCE can take these deposits, MINT new oneTOKENS (based on various strategies), and use them in farming opportunities on ICHI.

About ICHI

ICHI is a family of stablecoins (coins valued at 1 USD) designed to drive scarcity of member coins (ie, $oneIDLE = $1). ICHI exists to provide price stability and community treasury to projects like IDLE.finance, only the IDLE community governs its stablecoin treasury. ICHI is LIVE and works with coins and projects like BTC, ETH, LINK, and WING to enable them to grow their token economies.

How is the ICHI design better than other stablecoin designs?

The peg is guaranteed; redeeming $oneIDLE will always get the equivalent in USDC. However, unlike USDC, ICHI is 100% on-chain and non-custodial.

When minting a oneIDLE - you deposit exactly $1 - no need for over-collateralization, or getting into a debt position as the case is with other stablecoin projects.

Who is behind ICHI?

ICHI was created with a top team of devs from Microsoft, Amazon, RedHat, and IBM. ICHI had a 100% fair launch and has been community-owned from the first block. There was no pre-sale, no initial team cut, etc.

ICHI already collaborates with top DeFi dex like Bancor (ICHI token whitelisted) Sushi and 1inch (rewards program in place), and Balancer.

Towards launch of V2 in a few weeks, ICHI completed an audit process with Quantstamp & Solidified, and is in discussions with top DeFi projects to add them on the list of new oneTokens release roadmap.

Read more:

Website and docs - https://www.ichi.org/

Would love to get the community thoughts, questions and ideas on this proposal