Summary

This proposal is to approve the budget for Leagues M1-2023 (January to March 2023) contributors and operations, and a brief outline of the achieved milestones for M3 (more details will be released in the upcoming M3 Performance Report).

I am pleased to report that the M4-2022 quarter has been a very productive one for Idle Leagues. Our team has been laser-focused on product development, with a particular emphasis on both improving yield strategies and enhancing the user experience on the front-end side.

In addition to these efforts, we have also been busy executing and planning collaborations with key partners. These partnerships will allow us to leverage the strengths of both protocols and partners, and provide even more value to our users.

I am proud to say that the various teams at Idle Leagues are more committed than ever to achieving our mission of building an equitable and automated financial ecosystem. The recent CeFi debacles only serve to strengthen our resolve and drive us to continue pushing the envelope in this space.

M3-2022 Retrospective

As reported and planned in the M3-2022 milestones, we have been proud to announce numerous integration partners, and have made significant strides in improving our dashboard and yield strategies. Find below a closer look at some of the key achievements of the past quarter:

Integration/Collaborations

Integration/Collaborations

- Enzyme integration for Best Yield strategies on Polygon

- Hidden Hand stkIDLE integration

- Sense Finance fixed-yield integration for stETH PYTs

- Spool.fi integration for Euler PYTs

- stMATIC LDO rewards campaign with Lido

- Stablecorp YAAS integration for PYTs

- Merlin/Valk Tracker integration for both BY and PYTs

New Dashboard Release

New Dashboard Release

We have successfully released our brand new dashboard, which has been met with overwhelmingly positive feedback from our users:

Yield Product Development

Yield Product Development

- IIP-26 & IIP-27 to add Clearpool Wintermute & Folkvang to Best Yield Strategies, beginning the transition to a unified BY+PYTs offering.

- stMATIC PYTs product release

- ERC-4626 for PYTs to scale up integration workflow

And ultimately, as we close the books on 2022, we wanted to take a moment to reflect on all that we accomplished as a DAO over the past year. Enjoy the 2022 Year in Review.

M3-2022 DAO Metrics

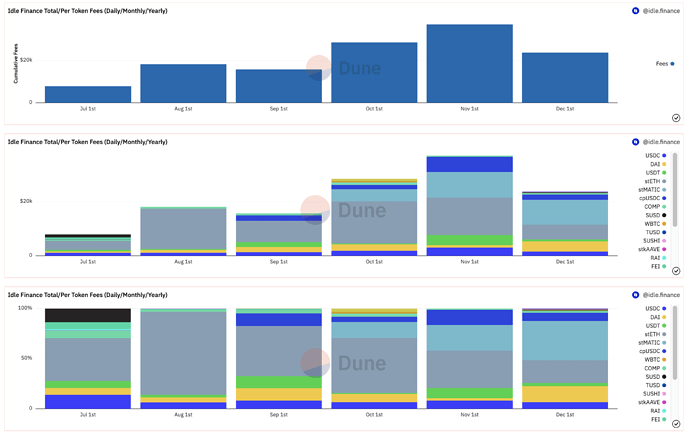

While there will be a more comprehensive analysis of the performance and metrics for M3 with the upcoming M3 Performance Report, here below is a quick overlook of the TVL and fees for Idle DAO:

TVL

Average TVL has been $61M thought M4-2023, with 104M peak (stable wrt M3-2022)

BY & PYTs Fees

Overall $102k (+50% wrt M3-2022) has been accrued by the product suite, with about $13k coming from the seed liquidity provided by Treasury League into stMATIC Senior Tranche. Of the aggregated fees, 67.5% is coming from PYTs and 19.7% from BY strategies.

Budget vs. actual

The performance report for the current period will be released in the coming days, providing a more detailed look at the balance sheet and income statement for Idle DAO. This report will give our tokenholders a better understanding of the financial health and performance of the DAO and its product suite.

Leagues M1-2023 Quarterly Goals

Keep evolving BY+PYTs

The first chapter of BY+PYTs evolution has been written with the introduction of Clearpool pools into Best Yield strategies – our long-term vision for the product suite is to create different layers of yield automation/aggregation via BY on top of a plethora of PYTs. The idea is to provide different layers of yield, and these different layers would allow different user profiles to access DeFi yield and customize their yield experience.

From top to bottom, users/integrators can use fully aggregated Senior/Junior Best Yield strategies to access full-spectrum yields, without bothering to chose the exact yield source or managing rebalances across underlying protocols; on the middle-level, we have the thematic verticals: this is where both users/integrators and sophisticated LPs meet; these tranches are made up of a broad portfolio of individual yield sources and can help reduce the risk that comes with deploying liquidity into a single one. It would provide the foundation or starting point for a diversified portfolio, with one-stop exposure to a given segment of the market. Lastly, we have the plethora of segregated PYTs, that would allow sophisticated liquidity providers to compose their own yield portfolio and build up their own preferred risk-reward ratio.

For M1-2023, we are going to focus on building the segregated pools layer and, when we see a fit, we will be moving up to the other layers.

New underlying strategies for PYTs+BY yield spectrum

To fulfill what was mentioned above, we already have an expected yield roadmap for the next strategies we want to integrate. We already have some strategies in pipeline, which are:

- Euler staking PYTs: this would allow to create a potentially higher yield for USDC, DAI and USDT and can be later integrated into BY to increase APYs on that product line as well.

- Generalized leveraged strategies: it allows to supply and borrow assets (potentially USDC/DAI/USDT/ETH/stETH) on Compound v2 & v3/Aave v2 & v3/Euler/Morpho and simultaneously earn rewards.

Pending further technical feasibility review, more yield simulations, and feedback from the customer base, some other yield strategies which are currently on the radar are:

- Gearbox PYTs leveraged credit account

- FRAX Lend Best Yield

- GMX/dYdX/Panoptic/others PYTs with delta-neutral strategies

Tokenomics & DAO Structure

- IDLE liquidity mining: the current IDLE emission on BY and PYTs (latter via Gauges) will end soon (approx end of Jan 2023); we will follow up in the next week with a proposal to update the current liquidity mining program to make it more efficient for both liquidity providers and tokenholders perspectives.

- DAO legal structure: despite using a nonverbose approach, we’ve been continuing to pursue research for the DAO legal structure; the environment for DAOs has been continually changing over the last year, and won’t be likely stopping for the year ahead as well. The currently available structures can create more constraints than benefits (both on DAO level and operational level); so the sentiment is to pursue a leaner structure in the short term, that would allow DAO contributors to legally contribute. And for the long-term, with more legal clarity over DAOs (which we hope and will strive to be proactive with regulators to make it for 2023), we will re-evaluate to wrap the entire DAO.

- Governance mining: we will release, in Jan 2023, a report that analyses the last 6-months of the program to understand its efficiency with regards to vote participation, governance forum activity and other DAO metrics; based on the results and the feedback from tokenholders, we will decide how to stir the program to continue improving the DAO activity.

Leagues M1-2023 Expected Budget

The expected budget for M1-2023 is in total $53’900: $28’590 in stablecoin and 68’739 IDLE (with 20-day rolling price) – current Treasury League multisig holdings can cover these expenses, so no IIP is required at the current time.

Next Steps

This post is open for feedback and will be voted via Temperature Check early next week. If positive, the M1-2023 mandate will be officially approved.