Summary

Tough times never last, but tough people do. This proposal is for the approval of the budget for Leagues M3 (August to October 2022) contributors and operations.

The Idle Leagues has been through a substantial restructure, and we are adopting a leaner organizational structure whilst we navigate through challenging market conditions, committed to come out the other side a stronger more successful business and an accountable Leagues workflow.

Leagues M2 Brief Recap

Following Leagues M2 Proposal roadmap, below is a report of the goals defined at the beginning of the mandate with their relative initiatives and achievements (both from product and organizational roadmap).

Achieved Goals

![]() Yield Automation Rebranding: Treasury, Dev, and Communication Leagues released the new face for idle.finance website, along with new robo-mascottes. Nonetheless, we’re already preparing the new uplift for the dashboard (see more below)

Yield Automation Rebranding: Treasury, Dev, and Communication Leagues released the new face for idle.finance website, along with new robo-mascottes. Nonetheless, we’re already preparing the new uplift for the dashboard (see more below)

![]() stkIDLE Gauges: After officially releasing stkIDLE Gauges in early April [link], Treasury, Dev and Communication Leagues have been onboarding Euler and Angle into Gauges (with Angle already providing rewards for stkIDLE holders). The next likely candidate is Clearpool.

stkIDLE Gauges: After officially releasing stkIDLE Gauges in early April [link], Treasury, Dev and Communication Leagues have been onboarding Euler and Angle into Gauges (with Angle already providing rewards for stkIDLE holders). The next likely candidate is Clearpool.

![]() Partnerships/Collaborations: With Treasury League creating and coordinating collaboration, Dev League building them into code, and Communication League giving them visibility, Leagues have been bringing the following D2D/B2B collaboration to the community:

Partnerships/Collaborations: With Treasury League creating and coordinating collaboration, Dev League building them into code, and Communication League giving them visibility, Leagues have been bringing the following D2D/B2B collaboration to the community:

- Lido D2D

- pBTC PYTs

- veTokenFinance Gauges boost

- Alchemix PYTs with treasury buyback

- APWine PYTs integration

- Olympus PYTs flywheel

- Euler PYTs

- Spool BY integration

- Clearpool PYTs

- Angle PYTs

- Mover BY and PYTs integration

![]() Communication and Growth: Leagues have been attending 4 DeFi conferences during this mandate, gladly meeting with community and D2D/B2B partners from the space (SpaghettETH, BlockSplit, ETHAmsterdam/DevConnect, ETHCC). Additionally, Communication League started a new format called DeFi and DAO talks with Twitter Spaces to let the community know more and ask questions to the closest partners of Idle DAO.

Communication and Growth: Leagues have been attending 4 DeFi conferences during this mandate, gladly meeting with community and D2D/B2B partners from the space (SpaghettETH, BlockSplit, ETHAmsterdam/DevConnect, ETHCC). Additionally, Communication League started a new format called DeFi and DAO talks with Twitter Spaces to let the community know more and ask questions to the closest partners of Idle DAO.

![]() Community Engagement: Treasury League and Communication League initiated the MetaDelegates program with UBC and Imperial College to help university blockchain clubs participate in Idle DAO governance, and Governance Mining program to reward active Idle DAO governance participants.

Community Engagement: Treasury League and Communication League initiated the MetaDelegates program with UBC and Imperial College to help university blockchain clubs participate in Idle DAO governance, and Governance Mining program to reward active Idle DAO governance participants.

![]() Leveraged staked ETH derivatives PYTs: Dev League is currently developing an Euler leveraged strategy for PYTs; it would allow to automatically supply and borrow assets on Euler simultaneously to earn EUL. It can be potentially applied to any asset in Euler.

Leveraged staked ETH derivatives PYTs: Dev League is currently developing an Euler leveraged strategy for PYTs; it would allow to automatically supply and borrow assets on Euler simultaneously to earn EUL. It can be potentially applied to any asset in Euler.

![]() PYTs Factory: achieve the long tail of assets: Dev and Treasury League have been collaborating with integration partners (such Clearpool, Truefi, and Euler) to refine a set of contracts and tests for a PYTs base strategy: while it’s still under review, it would allow partners to develop PYTs based on their yield sources autonomously. The next step is to turn it into a PYTs Factory accessible from UI.

PYTs Factory: achieve the long tail of assets: Dev and Treasury League have been collaborating with integration partners (such Clearpool, Truefi, and Euler) to refine a set of contracts and tests for a PYTs base strategy: while it’s still under review, it would allow partners to develop PYTs based on their yield sources autonomously. The next step is to turn it into a PYTs Factory accessible from UI.

![]() Best Yield 5.0: yield sources expansion: connectors and rebalance logic have been developed by Dev League, and Euler implementation is currently under review; it would allow depositing Best Yield assets into Senior Tranches (see below for more details). The next likely candidate is Clearpool USDC Senior Tranche.

Best Yield 5.0: yield sources expansion: connectors and rebalance logic have been developed by Dev League, and Euler implementation is currently under review; it would allow depositing Best Yield assets into Senior Tranches (see below for more details). The next likely candidate is Clearpool USDC Senior Tranche.

![]() Best Yield and PYTs Maintainance: Dev and Treasury League have been conceptualizing and implementing a huge improvement for PYTs yield split model: the Adaptive Yield Split; it allows to adapt the yield split between Senior and Junior depending on the deposited liquidity, allowing Seniors to get min 50% of underlying yield, while Junior to perform better than underlying yield, always. This has been implemented in all the PYTs now. Next step on this matter is to improve the default procedure for PYTs, in case a hack/loss occurs in the underlying yield source.

Best Yield and PYTs Maintainance: Dev and Treasury League have been conceptualizing and implementing a huge improvement for PYTs yield split model: the Adaptive Yield Split; it allows to adapt the yield split between Senior and Junior depending on the deposited liquidity, allowing Seniors to get min 50% of underlying yield, while Junior to perform better than underlying yield, always. This has been implemented in all the PYTs now. Next step on this matter is to improve the default procedure for PYTs, in case a hack/loss occurs in the underlying yield source.

Financials and Budget Recap

While the Treasury League will soon release a more comprehensive financial report for M2-2022, here’s a quick recap of the main KPIs.

- Aggregate TVL from ~$77M to ~66MM. TVL hit by major integrators downturn (Harvest TVL from ~$250M → ~$30M) but held up well with new integrators coming in

- PYTs TVL growing to $32M in July. Gladly, stETH with Lido D2D collaboration is performing amazingly with a TVL growth and new PYTs are getting traction and attention by the day

Regarding M2 budget, a non-comprehensive view of its deployment is the following:

- 46’365 USDC (15’455 USDC/month), of which 95% for Leagues Rewards and 5% for IGPs grants

- 114’597 IDLE (38’199 IDLE/month), of which 76% for Leagues Rewards, 21% for IGPs grants, and 1% for Ethereum B2B program[link]

- 2’314 MATIC (771 MATIC/month), of which 100% for Polygon B2B program

- 0.6 ETH (0.2 ETH/month), entirely for ops gas fees from Treasury League multisig

NB: M2 budget hasn’t been pulled out via IIP from any DAO fund for the last mandate, but Leagues autonomously managed excess inventories and reserves from previous activities; in essence, Leagues were able to self-found M2 mandate via treasury management activities without impacting the DAO treasury.

Regardless, as more detailed below, we are putting into effect immediately a number of actions which reduce Leagues expenses and focus Leagues efforts on high-value initiatives that aim to restore a break-even financial situation for the operative arm of the Idle DAO.

Revised Leagues Structure and Workflow

Leagues Contributor Brackets & Work Ethic Code

HR is a super complex process, let alone doing it in the “open”. Circumstances and personal situations are harder to reflect on in a context of a diverse DAO. As such, it’s likely easiest to have approximate brackets - and then allow some ad-hoc stuff on the margins by allowing for some small degree of subjectivity given a contributor’s background. This can, later on, be decided by an actual HR League as Idle DAO grows. For now, the brackets reflect general market demand & complexity for each role (while being an oversimplification, of course) and make it more transparent between the DAO members and contributors on who gets what.

Transparent work process & reporting

The Leagues contributors will commit to mandate reports. The reports will be shared and completed by contributors on a monthly or bi-monthly (in case activity is lower) basis and will be on a Notion public page.

Accountability: self-reporting and max hourly compensations

It should be noted that one can’t practically self-report a 100 hour week (despite devs doing that and beyond) simply because the discussions on “why X task took you so much time” would become very problematic as the DAO scales. It would be too subjective. As such, the maximum of a salary as per the above screenshot - is really the maximum unless there are some extraordinary circumstances.

At the end of the month, every contributor can quote how much they have been busy with certain tasks. Most of the roles have concrete activities so it would be fairly easy to understand how much time one or the other task could have taken. But just to be sure, a few Discord messages and a couple of tweets can’t justify even a 25% capacity. Common sense should be exercised.

Keeping full flexibility for everyone involved

The above rewards match similar roles outside of the crypto world, whereas here there is also extra IDLE. These IDLE rewards will be vested to create an extra incentive for a contributor to work more and stay aligned with the success of the protocol. Contributors are not required to be online 24/7 and can pursue their other hobbies or projects. As such, there is no need for hard control of KPIs and such - which is practically impossible in the context of a DAO anyway. While those would be great to do, for non-dev roles it’s extremely subjective and unclear. Dev capacity in most cases is expected to be at 100% minus the normal days off or force majeure sickness/partying.

For example, lack of motivation or lack of available work from a contributor will make it seamless for them to rotate out and not feel stressed. Meanwhile, strong motivation will result in full USDC compensation and extra IDLE tokens vested for the same $ value as the work dedicated to Idle DAO and Leagues that given month.

Leagues M3 Structure, Goals & Budget

M3 Leagues formation: the Contributors League

While Leagues have been evolving a LOT during the last 1.5 years, expanding and shrinking depending on the needs/phase of the DAO and its product suite, we are adopting a “do more with less” approach. The contributors and the treasury need to scale back to a number that can manage multiple subDAOs without high operational overhead. As such, the current group together with founding members become more on the operational side, whereas we will spin back off multiple subDAOs later on or help manage subDAOs that grow out in the future. That is for the next hiring wave.

These actions and the revised budget and cost restructure, as reported below, will be implemented in August to reduce Leagues expenses by -60% compared to M2 budget.

Hence, we are moving to a more simple, compact, and lean team structure, with a unique subDAO, the Contributors League, which handles:

- Development (smart contract & front end): 2 FT, 1 PT

- Design: 1 FT

- Marketing: 1 PT

- Coordination & Ops: 1 FT

- Partnerships/BD: 2 FT

- Grants: 1 PT

Concrete packages and contributors for Leagues M3

The following table is self-explanatory. The last two columns refer to the approximate monthly dedication of each contributor (due to what their role entails) in normal circumstances. That helps estimate the approximate budget for contributor compensations in USD.

Counting July as M2 rewards, and August/September with the revised M3 rewards, we get to a required budget of $36k in stables or eq, and 88k IDLE.

Leagues M3 Quarterly Goals

The following initiatives is what the Contributors League will focus on and aim to ship during M3-2022:

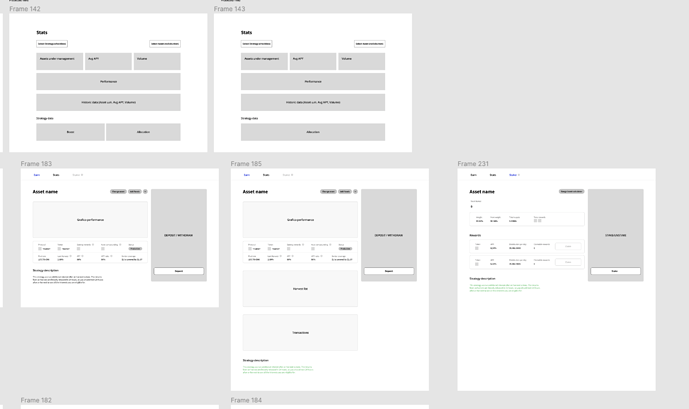

Renovate dashboard

Simpler, faster, and more intuitive dashboard, reducing maintenance and overhead costs. This will allow product suite users to enjoy using BY or PYTs daily and solve hiccups like loading time and data consistency. It is already under development with Dev and Design contributors, currently at the end of the wireframing phase as the following pics show.

Information Architecture Development:

New Dashboard Wireframes:

Prepare BY/PYTs next iteration

Simplify the product offering. Continue iterating, testing, and experimenting with the new PYTs design (like the Adaptive Yield Split), taking new yield sources into production (DeFi uncollateralized loans or decentralized options strategies), and ultimately implementing into the current BY a wider yield spectrum with PYTs Seniors (which will maintain BY’s high-security standard).

New Best Yield Architecture:

Other yield sources for PYTs like uncollateralized lending protocols, Decentralized Option Vaults, and more AMMs will be taken into considerations as new PYTs yield sources.

In general, this means an higher APY for Best Yield, and even more boosted APYs for Junior PYTs.

Keep up building B2B partnerships

Keep focusing on automation and support for integrators, both downstream and upstream. Build better tools, documentation, and tracking. Restore and grow TVL from there.

We have 4 product verticals for BY and PYTs:

- New yield sources (eg Morpho, TrueFi)

- New liquidity providers (DAOs, institutional funds)

- New coverage features (de-pegging risk for stablecoins)

- New products evolutions (pooled/aggregated Senior/Junior PYTs - if we see demand)

The programs that the partnerships/BD contributors can use are:

- Lido D2D: discover partners to reach $50M-100M-150M TVL thresholds as per D2D collab

- Polygon B2B: discover partners that can deposit >$100m TVL with MATIC rewards for 20% APY boost

With the BD contributors we will continue to build up TVL growth with these verticals and programs.

Update tokenomics and improve Gauges

Onboarding new partners for Gauges and keep kickstarting the Gauges flywheel, as already started with Angle DAO. Additionally, we will release a revised version of the tokenomics, specifically with an adjustment of the IDLE liquidity mining and Gauges distribution, with a substantial reduction of the overall emissions of IDLE tokens.

Maintain our high-security standards

Of course, continue building a resilient product suite to provide the most attractive risk-adjusted yields in the market. A DeFi protocol operating since 2019 without any hack/loss is a unique phenomenon. And we will keep maintaining it via monitoring, peer reviews, audits, risk framework, testing, and simulations. One of the main initiatives here will be to formalize and structure an improved PYTs Default Management Procedure.

Grow brand and community of users

Focus on Twitter communications with targeted research efforts to explore new channels and marketing campaigns. Continue with B2B content series (like the Treasury Mgmt article, or B2B Partners Twitter Spaces). And grow a community of users that enjoy using PYTs and BY, builders that strive to research and build new strategies and tools for integrators, and governance participants that want to help improve the overall DAO workflow.

Next Steps

This post is open for feedback and will be voted via Temperature Check in 5 days. If positive, the budget transfer will be included in the next IIP.